salt tax deduction news

State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in. 12There has been a lot of discussion amongst government leaders.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Paying a state income tax.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

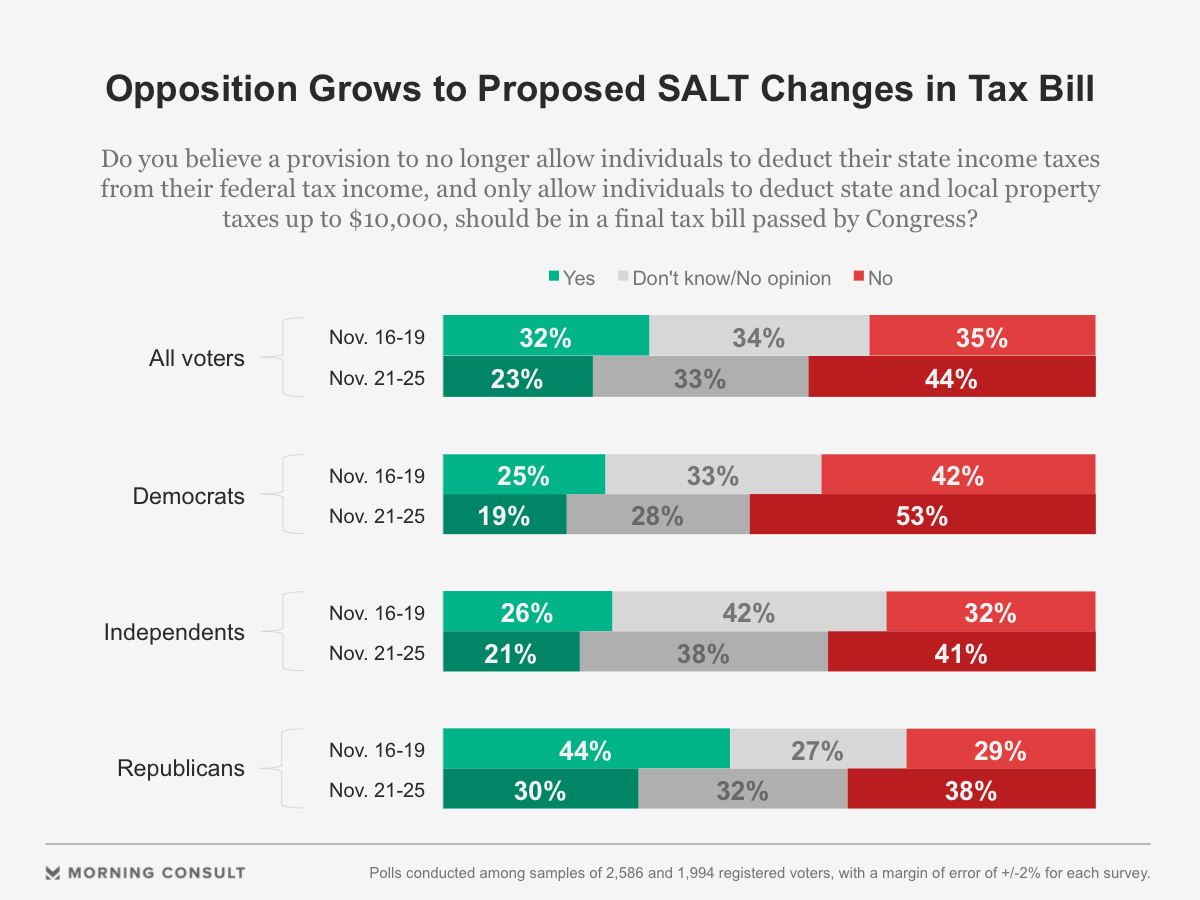

. Republicans established the 10000 cap on the SALT deduction in an effort to raise revenue to help offset the cost of tax cuts elsewhere in their 2017 law which reduced. That was bad news for top earners in blue states such as California and New York. Tom WilliamsCQ-Roll Call Inc via.

Erin Cleavenger The Dominion Post Morgantown WVa. December 12 2021 318 PM PST. The Supporting Americans with Lower Taxes SALT Act sponsored by US.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. April 18 2022 146 PM 4 min read. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to.

The TCJA reduced the. The bill would make a workaround to the federal 10000 cap on state and local tax deduction retroactive to. 52 rows Like the standard deduction the SALT deduction lowers your adjusted gross income AGI.

Bloomberg Law -- The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed. Colorado lawmakers advance a retroactive SALT cap workaround. Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. December 12 2021 930 AM 4 min read.

However nearly 20 states now offer a workaround that allows. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial.

While all attention these days seems to be focused on that other Supreme Court case we want to point out that two weeks ago the Court tersely refused to consider a. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for married taxpayers filing.

As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax. But the Tax Cuts and Jobs Act limited that deduction to 10000. Bill Ackman says that raising the state and local tax deduction -- known as SALT -- to 80000 makes no sense joining the debate over a.

A Democratic proposal aims to restore the SALT deduction for taxpayers who make.

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

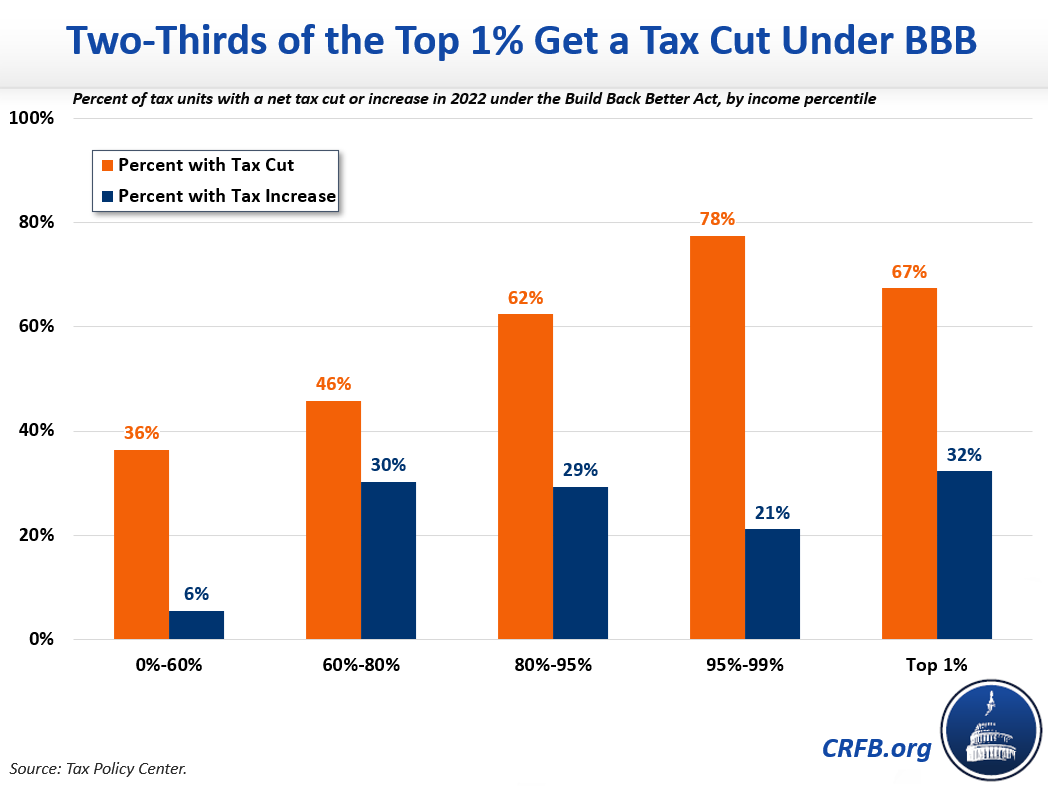

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

This Bill Could Give You A 60 000 Tax Deduction

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja Deduction Standard Deduction Inherited Ira

The Impact Of Eliminating The State And Local Tax Deduction Report

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Voters Increasingly Oppose Proposed Salt Deduction Changes

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

Left Wants To Give Wealthy Constituents Bigger Salt Deduction