indiana real estate tax lookup

Taxes are due and payable in two 2 equal installments on or before May 10 and November 10. Free Indiana Property Tax Records Search.

Enter the Tax ID Number as numbers only.

. The official website of Hendricks County Indiana. View and print Assessed Values including Property Record Cards. Pay Your Property Taxes.

Use First Name Last Name Example. The information provided in these databases is public record and available through public information requests. When this occurs the tax due date is the next business day.

Meth Lab Site Database. Property taxes are due in two 2 installments. FirstNameJohn and LastName Doe OR.

Use this application to. Use our free Indiana property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. It may not reflect the most current information pertaining to the property of interest.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in. A Indiana Property Records Search locates real estate documents related to property in IN. Use Address Example.

Ad Just Enter your Zip Code for Property Tax Records in your Area. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. 124 Main rather than 124 Main Street or Doe rather than John Doe.

Property Report Card. For an aerial view of your Property please utilize Beacons Property Search application Beacon. Indiana Supreme Court Filings.

Our property records tool can return a variety of information about your property that affect your property tax. Find information about filing Personal Property Forms. Search by address Search by parcel number.

What records are available to the public and what records are confidential. For best search results enter a partial street name and partial owner name ie. Just Enter Your Zip for Free Instant Results.

Disclaimer Madison County Treasurers Office 16 E 9th St. Find information about changing the mailing address for your tax bill. If you fail to receive a tax statement call the Treasurers Office before the due date and request a new tax bill.

View Ownership Information including Property Deductions and Transfer History. Please contact the Indiana Department of Revenue at 317 232-1497. Business Personal Property Taxes.

Indiana offers property owners a number of deductions that can help lower. Lake County Property Tax Payments will be accepted at this website until May 10 2022 at 1130. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Enter the number and a few letters of the remaining address if the property is not found shorten up on the criteria you entered. Search for your property to find its assessed valuation. You can search the propertyproperties by.

Visit the websites of these county offices for more information and news. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy. Enter the duplicate number found on your tax bill.

Why havent I received my tax bill. Easily Find Property Tax Records Online. Main Street Crown Point IN 46307 Phone.

Various Vigo County offices coordinate the assessment and payment of property taxes. Many County Assessor Offices provide an online searchable database whereby searches can be performed by parcel. You can find this number on your tax bill.

The county assessor is responsible for maintaining records for townships. 100 W Main St OR. Make and view Tax Payments get current Balance Due.

Property Tax Payments - Search. Change Tax Bill Mailing Address. Where can I find out how much homes have sold for in my area.

By selecting Beacon Online Mapping taxpayers can view real property personal property and mobile home property tax information real property record cards maps and other pertinent information related to the property. View and print Tax Statements and Comparison Reports. Land and land improvements are considered real property while mobile property is classified as personal property.

183335552227774003 Numbers Only Please use only 1 Search Option at a time. The due dates are May 10th and November 10th unless these dates fall on a weekend or holiday. What criteria must I meet to qualify for your IHCDA programs.

Search for your property. Available information includes property. When the list of properties comes up click the property you wish to view.

Taxpayers with questions about their tax bills may contact the Kosciusko County Treasurers Office at 1-574-372-2370. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents. Use 18 Digit Parcel Number Example.

Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E. Printview a tax bill or pay a tax bill. When you have selected your property you can.

Property tax statements must be mailed no later than April 15 2022. Property Reports and Tax Payments. Find Indiana residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more.

How much property tax do I owe. Court Case Filing Fees. Enter your last name first initial.

Number is located on the left corner of your tax bill. Real and personal property tax records are kept by the County Assessor in each Indiana County. Expert Results for Free.

Property Report Card Loading. Pay Your Real Estate Taxes. If an installment of real property taxes is completely paid on or before the date 30 days after the due date and the taxpayer is not liable for delinquent property taxes first due and payable in a previous installment for the same parcel the amount of the penalty is equal to 5 of the amount of delinquent taxes.

About Assessor and Property Tax Records in Indiana.

Treasurer S Office Tipton County In

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Records Information Hamilton County In

Wisconsin Property Tax Calculator Smartasset

About The Local Tax Finance Dashboard Gateway

Active This Adorable Three Bedroom In Castleton Is Going To Knock Your Socks Off That Kitchen Is Amazing Newly Find A Realtor Property Search Real Estate

Property Tax Search Taxsys Indian River County Tax Collector

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

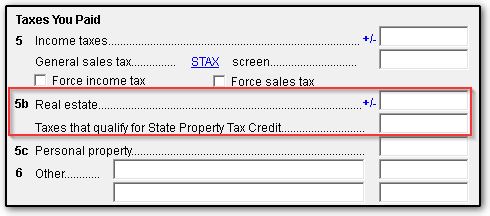

Real Estate Taxes Vs Personal Property Taxes

Indiana Property Tax Calculator Smartasset

How Are Property Taxes Paid Through An Escrow Account Citrus Heritage Escrow

Access Property Tax Assessment Records Tippecanoe County In

The Ultimate Guide To Indiana Real Estate Taxes

615 S Eisenhower Drive Real Estate Beautiful Homes Property